Equity Capital Essentials Training

Accredited by CPD & iAP | FREE e-Certificate Included | Unlimited Lifetime Access

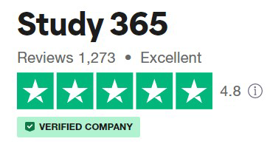

Study365

Summary

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Certificate in Equity Capital – Level 3

If you are a business owner, entrepreneur, or you hope to establish your own business, you need to understand equity capital. This course has been created by expert instructors, who have years of experience and a whole host of tips to share with you. The modules cover topics such as private equity, venture capital, and raising public equity.

Learning with Study 365 has many advantages. The course material is delivered straight to you and can be adapted to fit in with your lifestyle. It is created by experts within the industry, meaning you are receiving accurate information, which is up-to-date and easy to understand.

This course is comprised of professionally narrated e-Learning modules, interactive quizzes, tests, and exams. All delivered through a system that you will have unlimited access.

* Free E-certificate (No additional cost for E-certificates)

Why You Should Choose Study 365

- Lifetime Access to your course.

- The price shown on Reed is for the whole course, including the final exam and free e-certificate.

- CPD and IAP accredited certificate upon successful completion

- Tutor Support available Monday – Friday

CPD

Course media

Description

What will I learn?

- Understand equity, private equity, venture capital, and raising public equity

Course Description:

This online training course is comprehensive and designed to cover the key topics listed under the curriculum.

COURSE CURRICULUM

Module 1: Introduction To Equity

- Features of Equity

- Additional Features of Equity

- Different Types of Equity

- Corporate Funding Options: an Overview

Module 2: Private Equity

- Overview of Private Equity

- The Goals of Private Equity

- Private Equity Firms

- Attracting Private Equity

- Private Equity Deal Structures

- Private Equity Exits

- Example Deal Structure

Module 3: Venture Capital

- An Overview of Venture Capital

- Investors in Venture Capital

- Lifecycle of a Venture Capital Investment

- Conclusion

Module 4: Raising Public Equity

- Public Equity Markets

- Why Raise Public Equity

- Criteria for Listing

- The IPO Process

- Secondary Offerings

- Continuing Obligations

- Conclusion

Course Duration:

You will have lifetime access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time.

Method of Assessment:

At the end of the course, learners will take an online multiple choice question assessment test. The online test is marked straight away, so you will know immediately if you have passed the course.

Certification:

Successful candidates will be awarded an Equity Capital – Level 3.

Benefits you will gain:

By enrolling in this course, you’ll get:

- High-quality e-learning study materials and mock exams.

- Tutorials/materials from the industry leading experts.

- Includes step-by-step tutorial videos and an effective, professional support service.

- 24/7 Access to the Learning Portal.

- Recognised Accredited Qualification.

- Access Course Content on Mobile, Tablet or Desktop.

- A study in a user-friendly, advanced online learning platform.

- Excellent customer service and administrative support.

Who is this course for?

- School Leavers

- Job Seekers

- Managers

Requirements

This course requires no formal prerequisites and this certification is open to everyone

Career path

- Business Manager

- Private Equity Associate

- Investment Associate

- Corporate Actions Associate

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.